(Oslo, Norway, 28 May 2025) — Airthings’ (AIRX) revenues reached USD 9.2 million in the first quarter 2025, down 3 percent from the same period last year, with declining revenues in the Consumer segment and solid growth in the Business and Pro segments.

“We entered 2025 with a leaner organization, a focused strategy, and a strong commitment to improving profitability. Revenues were within our guided range and our gross margin improved from the previous quarter. Optimization of supply and availability across channels were main priorities,” says CEO Emma Tryti of Airthings, a global leader in indoor air quality monitoring solutions.

Despite increasing awareness and continued demand in North America, revenues in the Consumer segment dropped 13 percent, to USD 6.7 million, compared to the first quarter last year. The decline was driven mainly by lower realized product prices as distribution partners were more cautious and overall weaker consumer sentiment in the US.

Possible asset divestment and ongoing strategic review

In April, Airthings agreed a letter of intent with Firda AS for the sale of Airthings’ Business segment assets. In parallel, the Board engaged a financial adviser to seek out potential alternative bids and to conduct a strategic review of options for the company as a whole. The process was ongoing as of 28 May 2025, with interest received from several relevant parties underlining the quality and potential of Airthings.

“We believe that the ongoing strategic process will contribute to strengthening our financial position and secure long-term growth. Macroeconomic volatility, including US tariffs, affects growth, profitability and liquidity to a larger degree than previously anticipated. We will continue to monitor the situation closely and update the market as appropriate. In the meantime, we will continue our focus on efficient operations and financial performance,” says Tryti.

Continued consumer demand for safety-related products

Despite lower Consumer segment revenues, safety-related products performed well during the quarter, with solid sell-through numbers amongst key distribution partners during the first quarter. Airthings shipped approx. 71,000 such devices in the quarter, on par with the same period last year, while average realized prices decreased due to campaigns during radon action month in January and sales skewed towards low-priced products. Airthings successfully negotiated and renegotiated contracts with distribution partners with the aim of improving long-term unit economics and gross margins.

Healthy growth in the Business and Pro segments

The Business segment delivered revenues of USD 1.8 million, corresponding to 56 percent year-on-year growth in the quarter. The growth was driven by a steady deal flow and low churn rates.

Improving gross margin and reduced personnel costs

Gross profit was USD 5.6 million in Q1 25, down 3 percent from USD 5.8 million in Q1 24. The gross profit margin was 61 percent in Q1 25, up from 45 percent in the fourth quarter 2024 and stable compared to the first quarter last year.

Personnel costs declined 9 percent, to USD 3.3 million, following a reduction in full-time employees from 132 to 106 during 2024. Overall operating expenses increased 1 percent year-on-year, to USD 7.7 million, driven by increased sales commissions and marketing costs following a shift in our channel mix and launch of new retail partners.

The reported EBITDA in the first quarter was negative USD 2.1 million, compared to EBITDA of negative USD 1.8 million in the same period last year. EBIT for the first quarter was negative USD 2.5 million.

Short term outlook impacted by increased uncertainty

Sell-through levels at key consumer partners were healthy during Q1 and indicated continued category growth. However, sell-in during the first part of Q2 was impacted by increased uncertainty related to general consumer spending and the impact of US tariffs. This uncertainty is likely to be further accelerated by cautious inventory management among our distribution partners.

Airthings expect continued uncertainty related to the effects of US tariffs and a weaker sentiment amongst both consumers and businesses, especially in the US market. The situation makes it more difficult than before to predict both market development and revenues. Our current outlook indicates revenues in the range of USD 7.0 - 9.0 million in the second quarter 2025.

As communicated as part of the strategic review, the situation overall makes it prudent to secure additional capital to ensure a robust foundation going forward.

The interim report and presentation are attached to this release and available on www.airthings.com/investors.

Practical arrangements: The Q1 2025 results will be released at 07:00 (CET) on Wednesday 28 May 2025 and will be presented by CEO Emma Tryti and CFO Helge Øien at 08:00 (CET) at Danske Bank’s offices, Aker Brygge, Oslo, Norway. The presentation is open to the public and can also be followed via the following link: https://events.webcast.no/airthings/presentations/1q-2025-presentation

For additional information or media requests, please contact:

Helge Øien, CFO

ir@airthings.com

Emma Tryti, CEO

emma.tryti@airthings.com

About Airthings

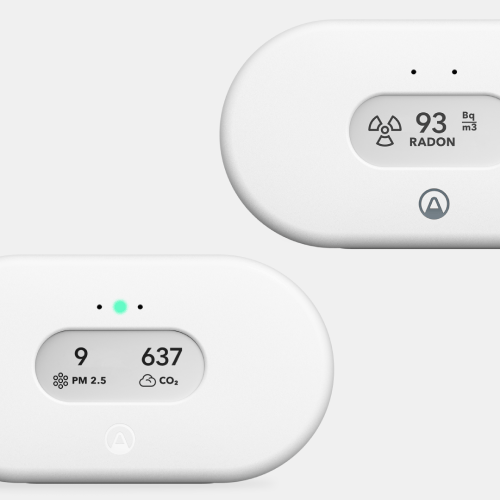

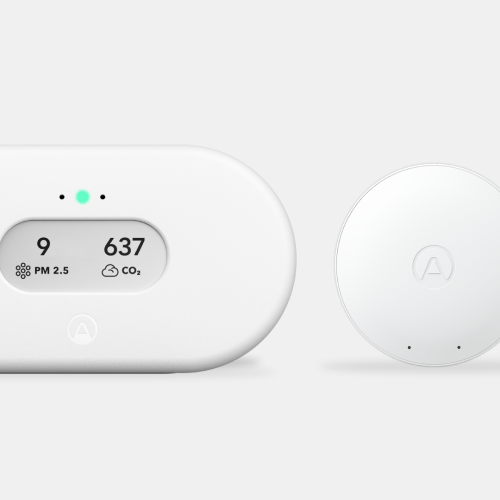

Airthings is a leading global technology company specializing in award-winning radon detectors and indoor air quality (IAQ) monitors for homes, workplaces, and schools. With a mission to empower people worldwide to understand and improve the air they breathe, Airthings offers accessible, accurate, and user-friendly solutions designed to enhance health and well-being through simple and affordable technology. Airthings has sold over 1 million devices worldwide. The company and its products have received the TIME Best Inventions Award and CES Innovation Award Honor. Headquartered in Oslo, Norway, with additional offices in the United States, Airthings continues to innovate and educate on the importance of continuous indoor air quality monitoring. For more information on Airthings’ comprehensive range of IAQ solutions and the benefits of healthy indoor air, please visit airthings.com.

%20(1)%20(1)%20(1).webp)

Back to top

Back to top