(Oslo, Norway, 15 December 2025) — Airthings ASA - Approval and Publication of Prospectus and Launch of Subsequent Offering

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN AUSTRALIA, CANADA, THE HONG KONG SPECIAL ADMINISTRATIVE REGION OF THE PEOPLE'S REPUBLIC OF CHINA, SOUTH AFRICA, NEW ZEALAND, JAPAN OR THE UNITED STATES, OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE, PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

The subscription period in the Subsequent Offering will commence at 09:00 (CET) today, 15 December 2025, and end at 16:30 (CET) on 22 December 2025 (the "Subscription Period").

The Subsequent Offering will be directed towards existing shareholders as of 8 September 2025 (as registered in VPS on 10 September 2025 (the "Record Date") with less than 375,000 shares and who were not allocated shares in the Private Placement and are not resident in a jurisdiction where such offering would be unlawful or would (in jurisdictions other than Norway) require any prospectus, filing, registration or similar action (the "Eligible Shareholders"). Each Eligible Shareholder will receive 6.51159 non-tradeable subscription rights (the "Subscription Rights") for each Share held by such Eligible Shareholder in the Company as of the Record Date. The number of Subscription Rights issued to each Eligible Shareholder will be rounded down to the nearest whole number of Subscription Rights without compensation to the holder.

Each Subscription Right will, subject to applicable securities laws, give the preferential right to subscribe for, and be allocated, one Offer Share in the Subsequent Offering. Over-subscription and subscription without Subscription Rights will not be permitted. Subscriptions for Offer Shares must be made in accordance with the procedures set out in the Prospectus.

The terms and conditions for the Subsequent Offering are set out in a prospectus approved by the Financial Supervisory Authority of Norway on 12 December 2025 (the "Prospectus") in connection with (i) the Subsequent Offering and (ii) the listing of 800,000,000 new shares issued in the Private Placement, which were settled on a separate ISIN (the "Private Placement Shares") pending publication of the Prospectus. Upon publication of the Prospectus, the Private Placement Shares are tradable and listed on Euronext Oslo Børs on the Company's ordinary ISIN NO0010895568 and under the ticker code 'AIRX'.

Subscription for Offer Shares may be made by submitting a correctly completed subscription form, attached as Appendix A to the Prospectus, to DNB Carnegie, a part of DNB Bank ASA (the "Manager") in accordance with the terms and conditions set out in the Prospectus. The subscription form and the Prospectus is, subject to regulatory restrictions in certain jurisdictions, available at the Manager's website (https://www.dnb.no/emisjoner).

Subscribers who are Norwegian residents with a Norwegian personal identification number (Nw.: fødsels- og personnummer) are encouraged to subscribe for Offer Shares through the Norwegian VPS' online subscription system (or by following the link on https://www.dnb.no/emisjoner which will redirect the subscriber to the VPS online subscription system).

Allocation of the Offer Shares is expected to take place on or around 23 December 2025. Notifications of allocation of Offer Shares and the corresponding subscription amount to be paid by each subscriber are expected to be made available by the Managers on or about 23 December 2025. Assuming that payments from all subscribers are made when due, it is expected that the share capital increase will be registered in the Norwegian Register of Business Enterprises on or about 12 January 2026 and that the delivery of the Offer Shares will take place on or about 13 January 2026.

This information is subject to a duty of disclosure pursuant to Section 5-12 of the Norwegian Securities Trading Act.

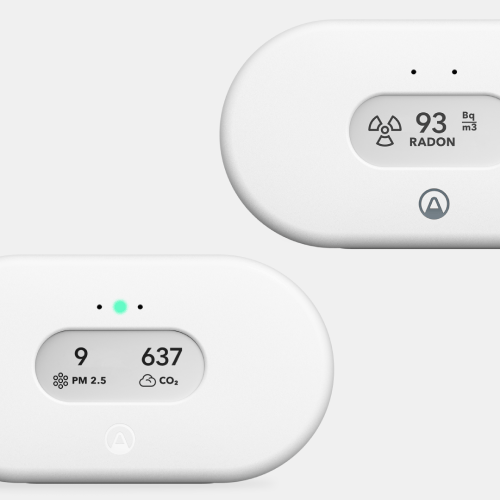

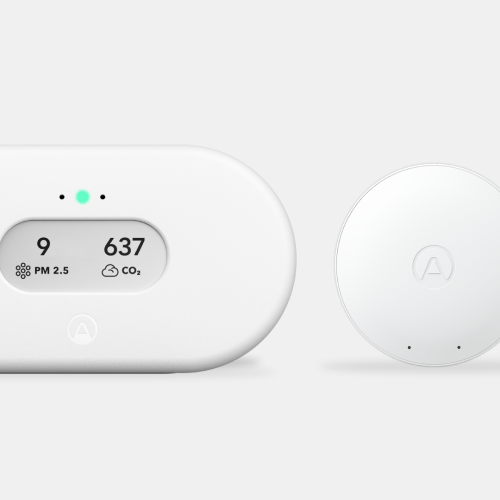

About Airthings

Airthings is a leading global technology company specializing in award-winning radon detectors and indoor air quality (IAQ) monitors for homes, workplaces, and schools. With a mission to empower people worldwide to understand and improve the air they breathe, Airthings offers accessible, accurate, and user-friendly solutions designed to enhance health and well-being through simple and affordable technology. Airthings has sold over 1 million devices worldwide. The company and its products have received the TIME Best Inventions Award and CES Innovation Award Honor. Headquartered in Oslo, Norway, with additional offices in the United States, Airthings continues to innovate and educate on the importance of continuous indoor air quality monitoring. For more information on Airthings’ comprehensive range of IAQ solutions and the benefits of healthy indoor air, please visit airthings.com.

Important notices:

This announcement is not and does not form a part of any offer to sell, or a solicitation of an offer to purchase, any securities of the Company. The distribution of this announcement and other information may be restricted by law in certain jurisdictions. Copies of this announcement are not being made and may not be distributed or sent into any jurisdiction in which such distribution would be unlawful or would require registration or other measures. Persons into whose possession this announcement or such other information should come are required to inform themselves about and to observe any such restrictions.

The securities referred to in this announcement have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the "Securities Act"), and accordingly may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and in accordance with applicable U.S. state securities laws. The Company does not intend to register any part of the offering or their securities in the United States or to conduct a public offering of securities in the United States. Any sale in the United States of the securities mentioned in this announcement will be made solely to "qualified institutional buyers" as defined in Rule 144A under the Securities Act.

In any EEA Member State, this communication is only addressed to and is only directed at qualified investors in that Member State within the meaning of the Prospectus Regulation, i.e., only to investors who can receive the offer without an approved prospectus in such EEA Member State. The expression "Prospectus Regulation" means Regulation 2017/1129 as amended together with any applicable implementing measures in any Member State.

This communication is only being distributed to and is only directed at persons in the United Kingdom that are (i) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended (the "Order") or (ii) high net worth entities, and other persons to whom this announcement may lawfully be communicated, falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as "relevant persons"). This communication must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this communication relates is available only for relevant persons and will be engaged in only with relevant persons. Persons distributing this communication must satisfy themselves that it is lawful to do so.

Matters discussed in this announcement may constitute forward-looking statements. Forward-looking statements are statements that are not historical facts and may be identified by words such as "believe", "expect", "anticipate", "strategy", "intends", "estimate", "will", "may", "continue", "should" and similar expressions. The forward-looking statements in this release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although the Company believes that these assumptions were reasonable when made, these assumptions are inherently subject to significant known and unknown risks, uncertainties, contingencies and other important factors which are difficult or impossible to predict and are beyond its control.

Actual events may differ significantly from any anticipated development due to a number of factors, including without limitation, changes in investment levels and need for the Company's services, changes in the general economic, political and market conditions in the markets in which the Company operate, the Company's ability to attract, retain and motivate qualified personnel, changes in the Company's ability to engage in commercially acceptable acquisitions and strategic investments, and changes in laws and regulation and the potential impact of legal proceedings and actions. Such risks, uncertainties, contingencies and other important factors could cause actual events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. The Company does not provide any guarantees that the assumptions underlying the forward-looking statements in this announcement are free from errors nor does it accept any responsibility for the future accuracy of the opinions expressed in this announcement or any obligation to update or revise the statements in this announcement to reflect subsequent events. You should not place undue reliance on the forward-looking statements in this announcement. The information, opinions and forward-looking statements contained in this announcement speak only as at its date, and are subject to change without notice. The Company does not undertake any obligation to review, update, confirm, or to release publicly any revisions to any forward-looking statements to reflect events that occur or circumstances that arise in relation to the content of this announcement.

Neither the Manager nor any of its affiliates makes any representation as to the accuracy or completeness of this announcement and none of them accepts any responsibility for the contents of this announcement or any matters referred to herein. This announcement is for information purposes only and is not to be relied upon in substitution for the exercise of independent judgment. It is not intended as investment advice and under no circumstances is it to be used or considered as an offer to sell, or a solicitation of an offer to buy any securities or a recommendation to buy or sell any securities in the Company.

Neither the Manager nor any of its respective affiliates accepts any liability arising from the use of this announcement.

About Airthings

Airthings is a leading global technology company specializing in award-winning radon detectors and indoor air quality (IAQ) monitors for homes, workplaces, and schools. With a mission to empower people worldwide to understand and improve the air they breathe, Airthings offers accessible, accurate, and user-friendly solutions designed to enhance health and well-being through simple and affordable technology. Airthings has sold over 1 million devices worldwide. Headquartered in Oslo, Norway, with additional offices in the United States, Airthings continues to innovate and educate on the importance of continuous indoor air quality monitoring.

For more information on Airthings’ comprehensive range of IAQ solutions and the benefits of healthy indoor air, please visit airthings.com.

%20(1)%20(1)%20(1).webp)

Back to top

Back to top