(Oslo, Norway - 2 February 2026): Airthings ASA (OSE: AIRX), the global leader in indoor air quality monitoring solutions, provides the following trading update based on unaudited Q4 2025 results ahead of its delisting on 12 February 2026.

Airthings reports visible progress in its strategic turnaround during the fourth quarter of 2025, resulting from the earlier announced efficiency programme.

While executing on the cost reduction initiatives and improving unit economics, where margin contribution has been a priority, Airthings saw continued revenue growth in the Business and Pro segments during 2025.

Total revenues for the quarter are expected to be USD 9.8 million, increasing 47% from Q3 25 and compared to USD 10.3 million in Q4 2024. Total revenue for 2025 is expected to be USD 33.3 million dollar with 7% growth in the Business segment and 21% growth in the Pro segment, while Consumer revenues decreased 20% following the strategic decision to prioritize margin improvement.

Gross margin is expected to be 55% in Q4 2025, improving from 45% in Q4 2024. In 2025, gross margin increased to 59% (56% in 2024) following more restrictive campaign spending and operational improvements offsetting most of the negative impact from US tariffs.

Increasing the recurring revenue is a strategic goal for Airthings. The company ended 2025 with annual recurring revenues (ARR) of USD 4.7 million, growing 7% year-on-year.

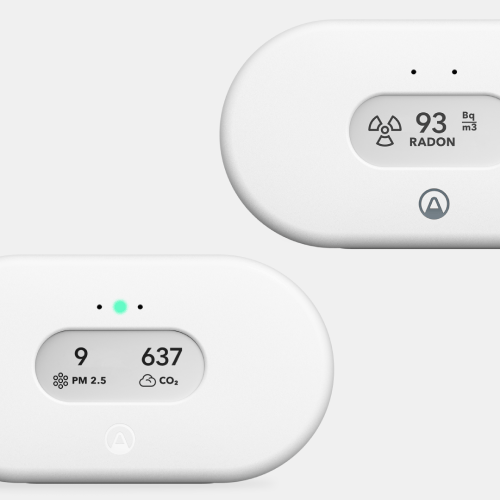

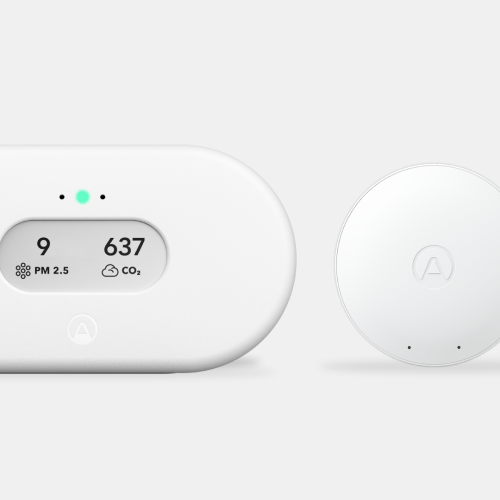

Airthings has shipped more than 1.5 million devices in total, including nearly 240,000 air quality monitors in 2025. This was partly driven by strong demand for its new radon detector, Corentium Home 2, launched in June 2025.

Following the communicated restructuring and reorganization, cost reductions are already visible, with personnel costs declining 26% YoY in Q4 and other operating costs declining 11% YoY. The improved margin and lower cost base are expected to improve the EBITDA to USD -1.9 million in Q4 2025, up from USD -4.2 million in the same period in 2024.

“In addition to seeing visible results from the hard work done over the last six months, we are also pleased to see improvement in our software subscription revenues. Significant wins from new customers and growth through existing customers have led to a solid development in our recurring revenue in the Business segment, which is currently up 36% percent compared to last year”, says Ivar Kroghrud, CEO of Airthing ASA.

In October 2025, Airthings applied for the delisting of the company’s shares from Euronext Oslo Børs. The Board of Directors and main shareholders are of the view that a delisting of the Company will enable the shortest path to profitability and future growth. The shares of Airthings ASA will be delisted as of 12 February 2026. The last day of trading will be 11 February 2026. The Board of Directors will meet to approve the 2025 results on 24 March 2026. The estimates provided in this release are therefore subject to finalisation and change.

This information is considered inside information pursuant to the EU Market Abuse Regulation and is subject to the disclosure requirements pursuant to Section 5-12 the Norwegian Securities Trading Act.

%20(1)%20(1)%20(1).webp)

Back to top

Back to top