(Oslo, Norway, 29 October 2025) — Airthings has during the quarter executed on its turnaround plan, including organizational restructuring and capital raise, and has created a simplified and more efficient operating model to support and serve its growing customer base.

Total revenues were USD 6.6 million in Q3 25, compared to USD 10.0 million in Q3 24. Overall, the revenue decline was driven by lower revenues in the Consumer segment, following strategic moves to improve unit economy and build-down of inventory at key partners. Year to date 2025, revenues declined 16 percent compared to the same period in 2024.

Airthings has taken decisions to reduce promotional funding in the Consumer segment to improve the unit economics and has also worked on reducing inventory at key partners. The Canadian market, which was a growth driver in 2024, saw a significant decline in revenues in the quarter. While partner inventory has been reduced, sell-through in key channels still grows year on year.

The Business segment delivered revenues of USD 1.7 million in Q3 25, declining by four percent year-on-year. Year to date, the Business segment has grown 11 percent both through market expansion and new purchases from large customers. Subscription revenues grew 7 percent. The Pro segment continues to deliver healthy year-on-year growth with revenues growing 25 percent in Q3 25.

Annual recurring revenue (ARR) came in at USD 4.6 million in Q3 25, corresponding to a growth of 7 percent year-on-year, with growth in both the Pro and Business segments.

Gross profit was USD 4.3 million in Q3 25, down 27 percent from USD 5.8 million in Q3 24. The gross profit margin was 64 percent in Q3 25, improving from 59 percent in the third quarter last year. The margin improvement is supported by a more disciplined approach to campaigns and discounts to retailers, but partly offset by increased tariffs on sales to the U.S.

As part of the restructuring of Airthings, actions have been taken to reduce the cost base going forward. In Q3 25, Airthings executed on a downsizing and recorded additional costs of USD 0.8 million related to personnel. Total employee benefit expenses were USD 3.3 million in the quarter, compared to USD 3.6 million in Q3 2024, when USD 0.9 million were taken in restructuring costs. Adjusted for these effects personnel expenses declined 5 percent. The number of full-time employees (FTEs) was reduced to 92 per end of Q3 25, down 27 percent from 126 FTEs at the end of Q3 2024.

Other OPEX increased from USD 3.6 million in Q3 24 to USD 4.1 million in Q3 25. Marketing expenses and other operating expenses increased in the quarter, mainly driven by increased bad debt, quarterly phasing of marketing costs and less capitalization of R&D.

The reported EBITDA in Q3 25 was negative USD 3.2 million, compared to EBITDA of negative USD 1.3 million in Q3 24. EBIT in Q3 25 was negative USD 3.6 million.

For additional information or media requests, please contact:

Helge Øien, CFO

ir@airthings.com

About Airthings

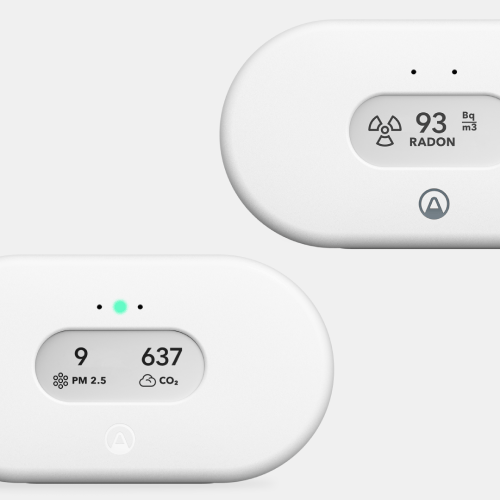

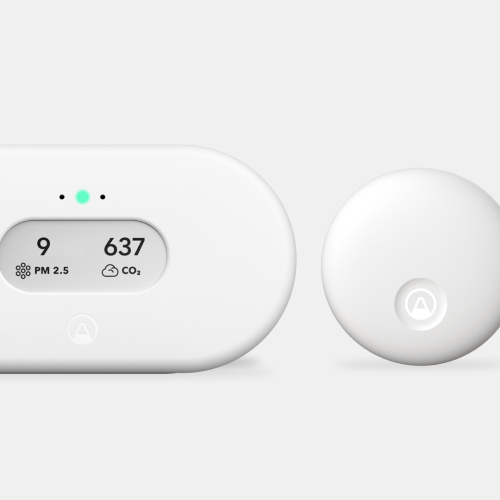

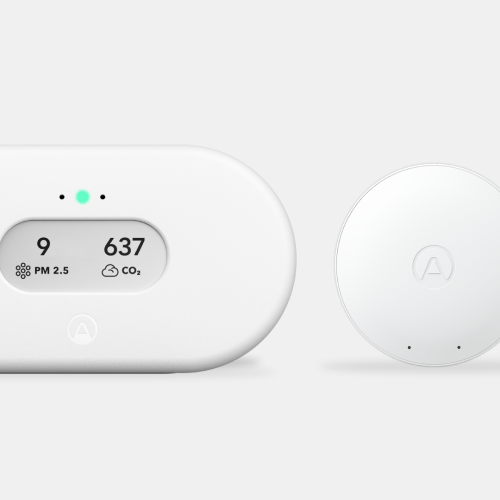

Airthings is a leading global technology company specializing in award-winning radon detectors and indoor air quality (IAQ) monitors for homes, workplaces, and schools. With a mission to empower people worldwide to understand and improve the air they breathe, Airthings offers accessible, accurate, and user-friendly solutions designed to enhance health and well-being through simple and affordable technology. Airthings has sold over 1 million devices worldwide. The company and its products have received the TIME Best Inventions Award and CES Innovation Award Honor. Headquartered in Oslo, Norway, with additional offices in the United States, Airthings continues to innovate and educate on the importance of continuous indoor air quality monitoring. For more information on Airthings’ comprehensive range of IAQ solutions and the benefits of healthy indoor air, please visit airthings.com.

%20(1)%20(1)%20(1).webp)

Back to top

Back to top