(Oslo, Norway, 8 September 2025) — With reference to Airthings ASA's ("Airthings" or the "Company", OSE: AIRX) Q2 2025 release on 27 August 2025, the Board of Directors of the Company has today resolved to propose a capital injection of NOK 105 million through a private placement of new shares followed by a subsequent repair offering (together the "Equity Offering"), each at a subscription price of NOK 0.10 per share and on the further terms described herein. The intention of the Equity Offering is to ultimately allow all shareholders to maintain their relative ownership of Airthings.

The Equity Offering has been fully underwritten by a consortium of 11 existing shareholders, including Firda AS, an investment firm controlled by Geir Førre, Chair of the Company's board. The net proceeds from the Equity Offering will be used for working capital and general corporate purposes.

DNB Carnegie, a part of DNB Bank ASA, has been appointed as manager for the Equity Offering (the "Manager").

Business update

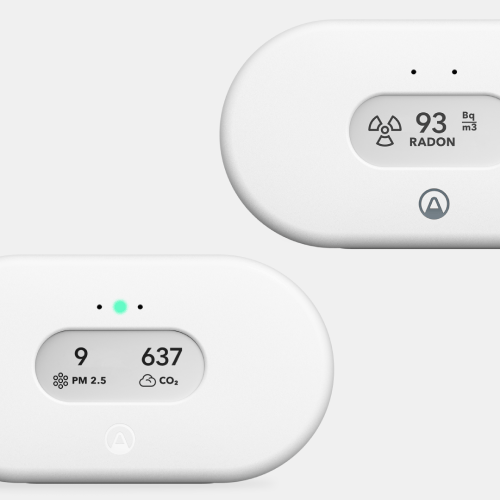

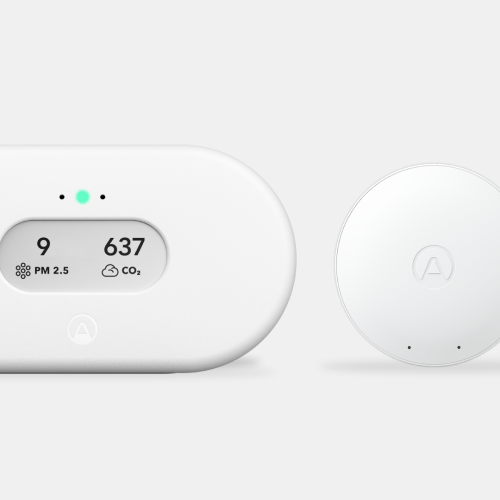

Airthings continues to see growth in sell-through at its key partners in eCommerce and retail in North America and has seen successful reception of its latest digital radon detector, Corentium Home 2. In the Business segment, repeat purchases from Fortune 500 companies is a testament to Airthings’ easy to use and reliable solutions.

Since the Q2 2025 report release, Airthings has successfully negotiated significant reductions in cost of build with strategic suppliers with effect on deliveries taken already from Q4 2025. This, combined with a more restrictive approach to campaigning and discounts is expected to drive improved unit economics in the coming years, although increased tariffs on sales to the U.S. continues to be a challenge for Airthings.

The Company has executed on a strategic rightsizing initiative designed to align its organizational structure with current market conditions and future growth objectives. The reorganization secures an optimized cost structure while preserving critical capabilities and market position, with strengthened focus on core competencies and high-value activities. The annualized cost savings are expected to be in the range of USD 4.0-4.5 million compared to 2024.

Airthings is undertaking a comprehensive review and optimization of its product portfolio, focusing resources on highest-value opportunities within its Consumer, Business and Pro segments. A new and rationalized product line will allow Airthings to focus on core, high-margin offerings within radon and indoor air quality. This will also drive enhanced R&D efficiency through strategic resource allocation towards improving the software experience by bringing actionable insight through AI, built on the vast volume of hard-to-obtain data for both Consumer and Business users.

The Company’s financial position and liquidity continue to be challenging and Airthings is dependent of raising capital to continue as a going concern. Per July 2025, revenues were declining 5% compared to the same period 2024 while inventories had increased to USD 14 million. The cash position per end of July 2025 was USD -0.3 million while Airthings per 5 September 2025 had drawn USD 2.8 million on its credit facility with Danske Bank. Airthings has entered discussions with Danske Bank regarding a new credit line and with Innovation Norway regarding potential instalment free periods. Discussions are so far constructive and supportive, contingent on Airthings securing additional equity.

While the actions taken and the initiatives identified will have significant impact on the cost base and profitability, 2026 is still expected to be a turnaround year for Airthings, creating the foundation for profitable growth.

While the Company will continue with Consumer, Business and Pro Segments, the plan is to gradually make the segments become more independent. The business segments will likely end up in separate entities owned by a joint parent company. Going forward this is expected to increase the focus on each segment, while facilitating potential strategic transactions.

Based on the strategic review announced by Airthings on 29 April 2005, the Company has attracted some level of interest in the Company and its business segments. This interest has, however, not materialized into anything concrete at this time. Given the Company's cash situation and funding need, the Board has therefore determined that the equity raise is a necessary and prudent way forward.

Details about the Equity Offering

The Equity Offering will be directed at the Company's shareholders as of 8 September 2025 (as recorded in Euronext Securities Oslo (the "VPS") on 10 September 2025) (the "Record Date"), who are not resident in a jurisdiction where such offering would be unlawful or would, for jurisdictions other than Norway, require any prospectus, filing, registration or similar action (the "Eligible Shareholders") and will be conducted in two parts by way of a private placement (the "Private Placement") followed by a subsequent repair offering (the "Subsequent Offering"), each as described below.

The Company's intention is for the Private Placement and the Subsequent Offering to secure funding for the Company's operations, while combined allowing all existing shareholders to participate in the Equity Offering and thereby maintain their current relative shareholdings pro rata and thus avoid dilution.

Completion of the Equity Offering will be subject to approval by an extraordinary general meeting of the Company to issue the new shares and to seek a de-listing of the Company from the Oslo Stock Exchange (the "EGM"). Shareholders participating in the Private Placement will as part thereof undertake to vote in favour of such resolution. The EGM will also consider a new board composition based on a recommendation from the Company's nomination committee. A notice for the EGM will be published separately, with the aim for the EGM to be held on or about 30 September 2025.

The Company has secured underwriting commitments for the full amount of the Equity Offering from a consortium of 11 existing shareholders (the "Underwriters"), which includes Firda AS. The Underwriters have agreed to subscribe in the Private Placement for their pro rata part of the Equity Offering, and have further agreed to subscribe for, and will be allocated, any shares not subscribed for by Eligible Shareholders in the Private Placement and the Subsequent Offering. The Underwriters will not receive any fee for their underwriting commitments, or preferred allocation in the Equity Offering (other than being allocated shares not allocated to other Eligible Shareholders based on their pro rata holdings).

The Private Placement:

The Private Placement will be directed towards Eligible Shareholders who as of the Record Date, hold 375,000 or more shares in the Company (approximately 50 shareholders). The Private Placement will not be subject to any minimum subscription or allocation amounts.

The subscription price per new share in the Private Placement will be NOK 0.10. The total gross proceeds of the Private Placement is expected to be around NOK 80 million.

The bookbuilding period for the Private Placement will commence on 9 September 2025 at 09:00 hours (CEST) and close on 11 September 2025 at 16:30 hours (CEST). The bookbuilding period may, at the sole discretion of the Company, in consultation with the Manager, be shortened or extended and may be cancelled at any time. If the bookbuilding period is extended or shortened, the other dates referred to herein might be changed accordingly.

Allocation will be determined after the bookbuilding period and conditional allocation will be made at the Board's sole discretion in consultation with the Manager, however so that the Board will strive to ensure that all subscribers receive pro rata allocation in line with their existing shareholding in the Company. Any unsubscribed shares above such pro rata allocation will be allocated to the Underwriters.

Notification of conditional allocation is expected to be issued by the Manager to the applicants on or about 12 September 2025. Completion of the Private Placement will remain subject to all necessary corporate resolutions being validly made by the Company, including the approval of the Private Placement and the conditional allocation by the Board and approval by the EGM of the issuance of the new shares and the filing of a de-listing application as described below. Further, completion of the Private Placement is subject to registration of the share capital increase pertaining to the Private Placement with the Norwegian Register of Business Enterprises and the new shares being validly issued and registered with the VPS.

Subject to fulfilment of these conditions, the Private Placement is expected to be settled shortly after the EGM. The new shares allocated to applicants in the Private Placement will be registered on a separate ISIN pending a prospectus (the "Prospectus") for the listing of such shares, and for the Subsequent Offering, being approved by the Norwegian Financial Supervisory Authority and published by the Company, and will pending such approval and publication not be tradable on the Oslo Stock Exchange.

The Subsequent Offering:

The Private Placement will require that the shareholders' preferential rights to subscribe for and be allocated the new shares are set aside. The Private Placement will however enable the Company to timely secure necessary funding and liquidity for the Company's operations, and is therefore considered by the Board to be both necessary and in the Company and its shareholders and other stakeholders' best interest. To ensure that all shareholders are afforded the same opportunity to subscribe for new shares and maintain their relative shareholding in the Company after completion of the Equity Offering, the Company will, subject to approval by the EGM, carry out a Subsequent Offering of new shares directed at those Eligible Shareholders who were not eligible to participate in the Private Placement.

The subscription price in this Subsequent Offering will be the same as the subscription price in the Private Placement, i.e. NOK 0.10 per share. The total gross proceeds of the Subsequent Offering is expected to be around NOK 25 million.

Allocation in the Subsequent Offering will be determined at the Board's sole discretion in consultation with the Manager, however so that the Board will strive to ensure that all subscribers in the subsequent offering receive pro rata allocation in line with their existing shareholding in the Company as recorded in VPS on the Record Date. Any unsubscribed shares above such pro rata allocation will be allocated to the Underwriters.

The Subsequent Offering will be conducted after the EGM and the potential mandatory offer described below, and after and subject to approval and publication of the Prospectus. Issuance of shares allocated in the Subsequent Offering is expected to be resolved by the board on the basis of a board authorization expected to be granted by the EGM. Further information on the contemplated Subsequent Offering will be given in a separate stock exchange release when available, and the complete terms will be set out in the Prospectus.

Employee stock option program

In order to attract, retain and incentivize key employees, the Board has resolved to implement a stock option program for employees. The program will comprise up to 15% of the company’s outstanding shares following completion of the Equity Offering. The option program is intended to align employees with shareholders and support long-term value creation.

Proposed approval of such stock option program will be included on the agenda for the EGM.

De-listing

As first announced on 27 August 2025, as part of and as a condition for the Equity Offering, a proposal will be made for the EGM to approve a de-listing of the Company from the Oslo Stock Exchange. If approved, the Company will file an application for such delisting with the exchange shortly thereafter.

The Board and main shareholders is of the view that a de-listing of the Company will enable the shortest path to profitability and future growth, while at the same time maximize exit opportunities in the years to come.

Mandatory offer

Firda AS, the Company's largest shareholder and currently holding 28.7% of the Company's shares may, depending on the number of subscriptions from other shareholders, as a result of the Private Placement and/or the Subsequent Offering and its underwriting commitments surpass 1/3 ownership of the Company. Should this occur, Firda AS will trigger a mandatory offer obligation, and thus be required to make a mandatory offer for the remaining shares at NOK 0.10 per share (the highest price paid by it the last six months) or reduce its holding below the threshold. Any offer, if required and made, will be made after completion of the Private Placement.

While Firda AS has agreed to be an Underwriter, it does currently not have any intention to increase its overall shareholding beyond any shares allocated to it as Underwriter. The Underwriters have therefore all undertaken not to accept such mandatory offer, if made, for any shares held by them (both currently held shares and any shares acquired through the Private Placement or otherwise), and any further subscribers in the Private Placement will be required to undertake the same, as part of the terms thereof. With respect to the shares to be issued in the Subsequent Offering, it is expected that these will be issued after completion of any such mandatory offer, and thus not be eligible for acceptance thereof.

For additional information or media requests, please contact:

Helge Øien, CFO

ir@airthings.com

About Airthings

Airthings is a leading global technology company specializing in award-winning radon detectors and indoor air quality (IAQ) monitors for homes, workplaces, and schools. With a mission to empower people worldwide to understand and improve the air they breathe, Airthings offers accessible, accurate, and user-friendly solutions designed to enhance health and well-being through simple and affordable technology. Airthings has sold over 1 million devices worldwide. The company and its products have received the TIME Best Inventions Award and CES Innovation Award Honor. Headquartered in Oslo, Norway, with additional offices in the United States, Airthings continues to innovate and educate on the importance of continuous indoor air quality monitoring. For more information on Airthings’ comprehensive range of IAQ solutions and the benefits of healthy indoor air, please visit airthings.com.

%20(1)%20(1)%20(1).webp)

Back to top

Back to top