Airthings (AIRX-ME) today announced strong results for the third quarter 2020, reporting a 50% increase in revenue compared to the same quarter last year and a 62% sales gross margin. In the company's first quarterly report after its listing on Merkur Market on 30th of October, Airthings reported strong growth in annual recurring revenue (ARR), with an increase of 153% YoY, improved customer product ratings and new feature launches.

“The third quarter has typically been a low season for us, but we have experienced significant growth and demand for both our consumer and commercial products throughout 2020,” says Øyvind Birkenes, CEO of Airthings. “Increased global focus on health, productivity and sustainability are all contributing to putting air quality among the top global topics. We are now well-positioned to meet this global demand, and continue our strong growth going forward.”

Key highlights for the third quarter 2020

- Sales revenues of NOK42.2m - up 50% YoY

- Sales gross profit of NOK26.3m - margin of 62%

- ARR reached NOK7.3m by end of quarter - up 153% YoY

- Successful acquisition of proptech company Airtight, increasing focus on energy efficiency in Airthings for Business.

- Opening of Airthings sales office in Stockholm, Sweden, with an experienced team from Yanzi Networks.

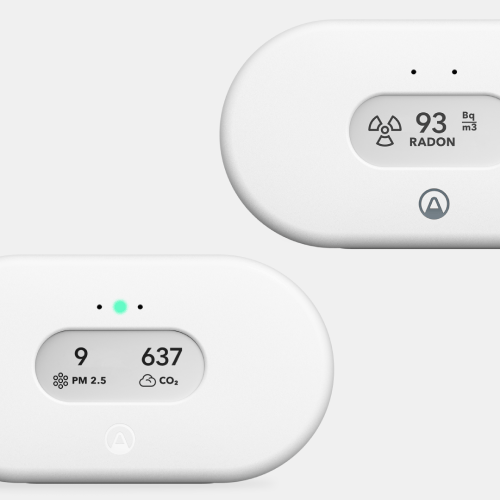

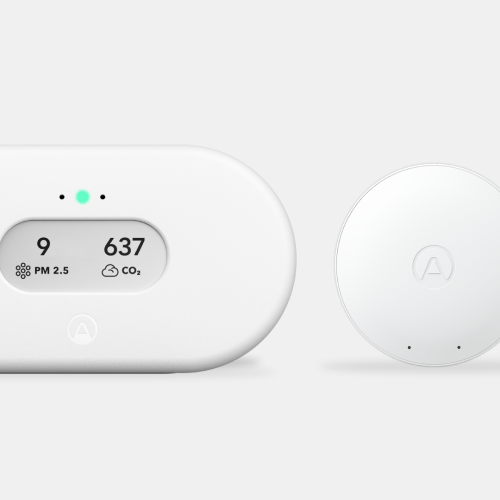

- Launch of Wave Mini with Mold Risk Indicator for consumer and business segments, with Amazon rating on Wave Mini passing the 4-star hurdle.

- IPO process launched in September

Subsequent events

- Private placement, raising NOK500m with the subsequent listing on Merkur Market on 30 October.

- Agreement with Schneider Electric signed on 17 November.

- Launch of Virus Risk Indicator, Airthings' second virtual sensor.

Financial results

Group total revenue reached NOK44m during the third quarter, representing a growth of 50% YoY. Gross profit margin was NOK28m implying a margin of 64%. Group EBIT for the quarter came in at -NOK10.7m. Major cost drivers include performance marketing costs, campaign costs and salary cost growth, all in accordance with planned expansion.

A live presentation of the third quarter results will be given by CEO Øyvind Birkenes and CFO Erik Lundby at 08.00 CET via this link.

A recording of the presentation will also be made available on airthings.com/investors.

For more information, please contact:

Nora PerezHead of PR

Press@Airthings.com

%20(1)%20(1)%20(1).webp)

Back to top

Back to top